by

N. David Milder

OVERVIEW

The 34th Street Shopping District, a 31-block area in Midtown Manhattan, is legendary both in the USA and throughout the world. It is the place where Macy’s, the world’s largest department store, famously battled Gimbel’s, and Hollywood showed that miracles can happen. Since around 1900, with its 2.2 million SF, 12 level mother store that occupies a whole city block, Macy’s has epitomized what a department store is all about. Its national chain has taken that brand and all of its connotations across the nation, helped by national TV coverage of its Thanksgiving Day Parade.

The district has several other famed and strong attractions: e.g., the Empire State Building, Madison Square Garden, Korea Way, Penn Station and the Farley Post Office – and the movies to prove it: e.g., An Affair to Remember, Sleepless in Seattle. It also has scores of mass-market national retail chain stores. Some of them are among the best performing in their chains. About 23 retail and food operations like the district so much that they have more than one location in it. According to the directory on the 34th Street Partnership’s website Starbucks, Duane Reade and Subway each have six!

Importantly, the district has some retail locational assets that are rivaled by only a few other districts worldwide. They are almost like paradigms. Consequently, the district is an excellent window on the future of brick and mortar mass-market retailing. How it develops in the district over the coming decade also will reveal much about whether or not the old dictum about “location, location, location” is still broadly operative.

For example, the district strongly benefits from access to many subway and commuter rail stations that have incredibly high daily passenger use levels. They help support daytime populations within 10-minute walks of 200,000+ for the district’s many street level retailers. The resulting high pedestrian traffic has become a crucial factor in attracting national retailers. Retailers don’t have to bring customers into the district, just into their stores.

Also, since 1995, when DANTH, Inc. first researched the district, tourism and tourist retail spending have become even more important for district merchants, and Macy’s became a well-established major international tourist destination.

The 34th Street Partnership’s website does a nice job of describing the district’s dynamic, if sometimes turbulent, history. It has had ups and downs and significant changes in some of its dominant uses, but it always rebounded.

Today, the district seems to again be facing an unsettled environment that offers opportunities for growth as well as for serious bumps in the road. On one hand, the nation’s retail industry, especially the middle-market portion of it, is facing serious challenges. Nationally, 2017 looks like it will be a banner year for store closings. Over the years, department stores such as B. Altman’s, Gimbel’s Stern’s, A&S, Saks and Korvettes have come and gone in the district. The Macy’s and JCPenney chains are now struggling nationally, as are most department store chains. This is also the case for many of the specialty retail chains that might favor a 34th Street location, though some of those already in the district are reportedly doing very well there. Importantly, 34th Street is attracting many of today’s most popular and successful fast fashion retailers: e.g., H&M, Zara, Forever 21, Superdry and Uniqlo. Significantly, Target has recently announced the opening of a 43,000 SF store right across 34th Street from Macy’s. On the other hand, the district so far has not attracted many of today’s successful off-price/discount retailers such as TJ Maxx, Marshall’s, Ross for Less, Nordstrom Rack, Century 21, etc. though it does have a DSW. Also an Amazon bookstore will open soon across from the Empire State Building on 34th Street.

Additionally, many areas within the district and surrounding it are undergoing substantial and meaningful redevelopment:

- The creation of well activated, densely used public spaces at Herald and Greely Squares as well as on a part of W33rd Street by Penn Station

- The construction of Moynihan Station and Manhattan West on 8th and 9th Avenues

- The development of the massive Hudson Yards project to the west of 10th Avenue

- The transition of Chelsea to the south and the Garment District to the north into neighborhoods where large numbers of creatives/knowledge workers live and work. They and nearby Murray Hill are also attracting a lot of venture capital investment. (1)

Furthermore, several properties in the district near Penn Station appear to be poised for major redevelopment.

How the district will traverse this period of uncertainty is now a very interesting, if still unanswerable question. What will its retailing look like ten years from now? Will brick and mortar shops still be important and what roles in the retail consumer purchasing process will they play? Can its strong locational assets keep its retail healthy when it is shrinking significantly in malls and other downtowns? Will traditional department stores still be around? Will the district’s growing central social district functions become even stronger and more important? More certain is that the district will pass through this transitional period with the incredibly strong assets described above as well as with a bevy of strong stakeholders that includes major retailers, heavily invested and deep-pocketed real estate companies, state and federal agencies and a proven and tested district steward, the 34th Street Partnership.

That the district again faces uncertainty should not be surprising. After all, it sits in one of the world’s largest CBDs, where change and turbulence are everyday expectations.

SOME WORLD CLASS RETAIL LOCATIONAL ASSETS

The incredibly strong locational assets of the 34th Street District make it a great place to see if such strong assets can still help keep brick and mortar retailing alive and well in our downtowns. Consequently, it is worthwhile detailing what those strengths are and how, in some instances, they are becoming even stronger.

Transportation. Rail travel, both commuter and inter-city, brings into the district a staggering number of people. For example, there are three major city subway stations in the district at 6th, 7th and 8th Avenues that:

- Provide access to 13 subway lines

- Have a combined total weekday average of 303,730 passengers entering the stations

- Rank 3,5, and 6 among NYC’s 421 stations in ridership.

Map 1. Zip codes where 70% of the interviewed 1,186 subway riders at 34th Street stations live. (From a 1995 DANTH, Inc report)

The map above and the interviews on which it is based were done back in 1995, but it is still of strong heuristic value. It shows how the district’s subways allow it to easily tap a vast proportion of NYC’s population: about 4.7 million people then lived in the shaded zip code areas. If anything, today that number is probably somewhat higher. An even larger number of people live in the district’s overall mass transit travel shed which also reaches into NJ, CT, Long Island and parts of upstate NY. The subway is just one part of this travel shed.

The three railroads that use Penn Station – Amtrak, New Jersey Transit and the Long Island Rail Road – bring in passengers from suburban communities and other parts of the nation. They report an average weekday ridership of 487,764.

In addition, the PATH 33rd Street Station has a reported daily ridership of 36,410. Path’s passengers largely come from NJ.

The district has benefited from Transit Oriented Development for many decades! Macy’s, Manhattan Mall (the old Gimbel’s location), Herald Center, the Penn Plaza office cluster and Madison Square Garden all virtually sit on top of one of these stations and are less than a five minute walk from the others.

Daytime Population. These transportation statistics indicate that the 34th Street district still draws lots of outer borough and suburban residents into the region’s urban core, but since WWII and the growth of the suburbs, that no longer means that it is the main retail shopping district for these suburbanites and outer borough residents. First the malls, then the big boxes and the Internet, have brought lots of retail purchasing opportunities out to the suburbs. Also, the city’s outer boroughs, once badly “under stored,” have experienced significant retail growth. There is less need among outer borough residents to do their retail shopping in Manhattan than in decades past. Consequently, the critical market area for the 34th Street District retailers is increasingly the 10-minute walk shed that surrounds each of their stores. The people who live, work and “play” within those walk sheds will most likely be their most frequent customers. They are often grouped together under the daytime population rubric. This population also will account for the vast majority of the district’s pedestrian traffic. The subway and rail passengers passing through the district are part of this daytime population, as are the tourists. Some may be transient members, though their aggregate numbers may be relatively stable and be dependably counted upon. Others, such as those who live within the walk shed and who work or study there are more likely to be regularly in the district and have greater knowledge of its retailers.

The importance of the commuters and tourists to the district’s retail recruitment was recently demonstrated when they were strongly underscored by Target’s Senior Vice President Mark Schindele, as he explained Target’s decision to open a new store in the district (2).

The Daytime Workforce. The map below shows what a roughly 10-minute walkshed centered on the Herald Square entrance of Macy’s looks like. Because of Manhattan’s street grid, it looks mostly like a diamond, not a ring. Because of the way Broadway cuts across the grid, the top and bottom points of the rectangle are snipped off. Retail locations in different parts of the district will have different walk sheds. They may also have slightly different shapes depending on how Broadway cuts through their neighborhood.

Map 2. A roughly 10-minute walkshed centered on Macy’s Herald Square entrance. (Generated in Census Bureau’s On-the-Map)

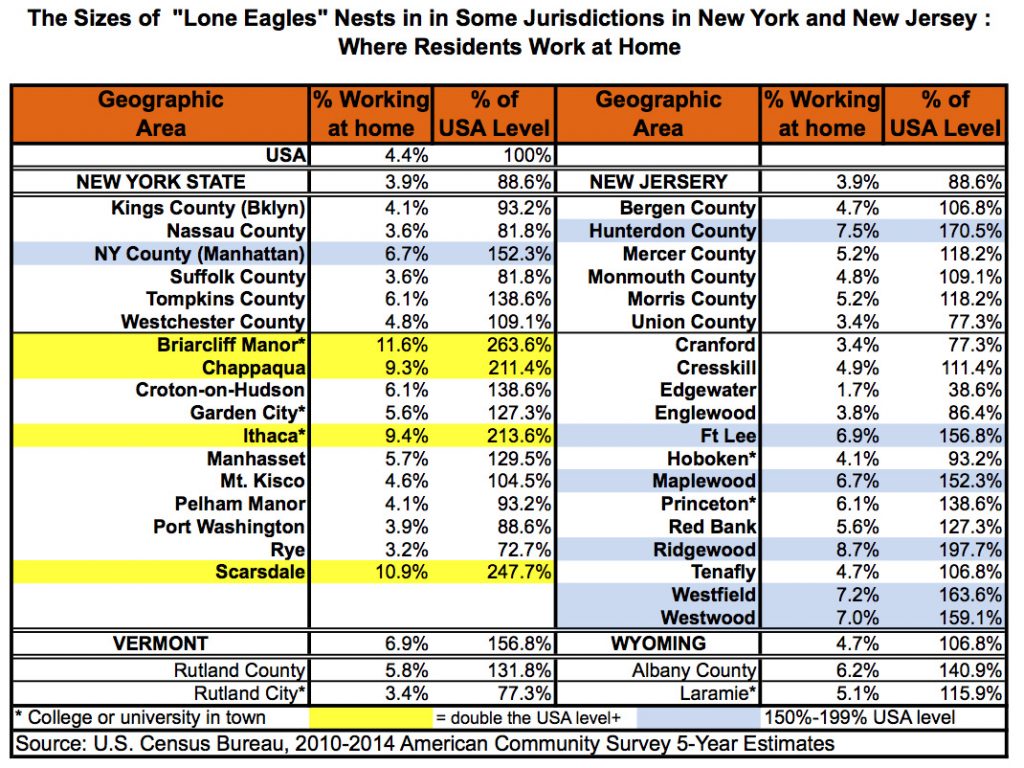

In 2014, about 239,528 people had primary jobs that were located in this walkshed. About 10% were in the retail trade industry, and about 13.2% were in Wholesale Trade. Another 3.7% were in manufacturing. A sign that important changes have been happening in and near the district are the significant number of knowledge worker type jobs: 15.8% in professional, scientific and technical services; 10.5% in administration & support, waste management and remediation and 10.4% in health care and social assistance. The influx of knowledge workers/creatives is happening not only in Chelsea and the old Garment District but in the 34th Street district as well. The Empire State Building has attracted some major high-tech firms such as LinkedIn and Shutterstock as well as a number of start-ups. Parsons Brinckerhoff has long been headquartered at 1 Penn Plaza, where Cisco Systems and a number of other high-tech and consulting firms also have offices.

The Manhattan West and Hudson Yards projects may develop about 9.68 million SF of office space in or adjacent to the district. If the office workers averaged occupying 200 SF of space per worker, these new projects would be bringing in a total of about 48,000 workers; at 175 SF per worker, the total would be about 55,000 new workers. Their potential impact on existing retail locations probably would be mostly in the western portion of the 34th Street District, though filtered by the 750,000 SF retail center (supposedly anchored by a Neiman Marcus) planned for Hudson Yards and at least 100,000 SF of retail space (including a Whole Foods) scheduled for Manhattan West.

Overnight Tourists. According to the 34th Street Partnership, there are six hotels in the district with 4,006 keys and another 17 hotels adjacent to it that have 2,965 keys. Together, the 23 hotels have 6,971 keys. At Manhattan’s current occupancy rate, around 88%, that translates into about 6,134 rooms or suites being occupied each night. Assuming that there are, on average, 1.4 guests per key then generates an estimate of about 8,587 tourists each day staying in or very near the district.

The district probably draws even more overnight tourists who are staying elsewhere in the city or metropolitan region. They tend to act like day trip visitors to the district who go to Macy’s and/or other retailers, the Garden, the Empire State Building, etc.

Day Trip Visitors. These are people who do not live or work in the district or who do not visit it on a consistent, multiple times a week basis, e.g., a student. They can be shoppers from the district’s extended trade area or other visitors who are in NYC for the day and visit one or more of the 34th Street district’s attractions.

- Macy’s and other district retailers. I have not been able to find any really good data on this subject. However, I think a useful, though certainly not definitive, ballpark answer can be cobbled together about Macy’s which undoubtedly has the strongest draw among the retailers:

- An interesting article in New York Magazine back in June of 2007 stated that 40,000 shoppers pass through Macy’s every day – 120,000 during the holidays (3). That’s, at a minimum, about 14.4 million shoppers per year. Most knowledgeable observers I’ve talked to feel that, regardless of the current problems facing the Macy’s chain, customer traffic at its 34th Street store has not dropped off appreciably (sales are another issue)

- A high-levelMacy’s executive told me some years ago that tourists had grown to account for a very substantial portion of the mother store’s shoppers and sales. At the chain level, international tourists have accounted for about 5% of revenues (4). All tourist transactions then probably accounts for about 10% of the chain’s sales. But, most of the chain’s tourist sales occur at a few of its 730 stores, e.g., Herald Square and the former Marshall Fields store in downtown Chicago. On that basis, let’s stipulate that “substantial” means between 25% and 40% of the Herald Square store’s shoppers are tourists

- That would then suggest that between 10,000 and 16,000 of Macy’s daily shoppers are probably tourists

- Based on data presented in a very interesting article by Mitchell L. Moss and Carson Qing, it seems reasonable to assume that about 51.93% of Manhattan’s tourists are out-of-towners who are staying overnight, while the remaining 40.07% are “day trippers” (5)

- In turn, that would suggest that on a normal day between 5,192 and 8,308 of Macy’s shoppers are probably out of town tourists staying overnight. They will spend more on retail than other tourists

- Korea Way. Much like Korea Town in LA and Chinatowns and Little Italys all over the nation, this cluster of businesses along 32nd Street between Fifth and Broadway featuring Korean cuisine, shopping and culture can draw people from a very wide area. The subway and Path lines on Greely Square greatly facilitate this. The number of people who visit annually is unknown, but its pedestrian traffic suggests it is substantial

- The Empire State Building. Though no longer the tallest building in the USA or the world, its views continue to draw about 3.5 million visitors annually

- Madison Square Garden. It holds about 320 events annually including professional basketball and hockey games as well as concerts. Its annual paid attendance is about 4 million.

Residents. According to data provided by the 34th Street Partnership, the district has 17 residential buildings with 2,813 units. Another nine buildings with 767units are on adjacent streets.

Map 3. Zip Codes Relevant to the 34th Street District.

The district is embedded almost entirely in Zip Code 10001 that contains a part of Chelsea, Korea Town and the Penn Station area. Most of this zip code is within a 10-minute walk of some part of the district. To the north is Zip Code 10018. It contains the Garment District and parts of the Bryant Park area and the Hell’s Kitchen neighborhood. Most of it is also within a 10-minute walk of some part of the 34th Street district. (Note: zips 10199 and 10119 shown on the map have just a handful of residents).

To the east is Murray Hill’s Zip Code 10016 that runs along 34th Street to the East River in a path that goes up to 15 blocks wide north and south. The part of the 34th Street District east of Fifth Avenue is in this zip code.

Many parts of zip 10016, especially near 1st, 2nd and 3rd Avenues, are not within 10-minute walks of some point in the district. However, New Yorkers tend to walk much longer distances than folks in other cities and a 20-minute walkshed from some point in the district would cover almost all of these three zip code areas.

Within these three zip code areas are 44,741 households with 63,351 residents – the equivalent of a medium-sized city. Most are in Murray Hill, a traditional residential neighborhood. Zips 10001 and 10018 have been dominated by non-residential uses. Notably, the residents of all three zip codes:

- Have a high labor force participation rate

- Are largely in creative class/knowledge worker occupations

- Have median household incomes above $86,000/yr

- Have very high rates of walking to work, 39.3% to 41.3%.

As best as can be determined from Internet searches, the Manhattan West and Hudson Yards development projects will produce between 5,900 and 6,700 new residential units and households in and very near the district. That would be a 13% to 15% increase in the number of zip code households. Moreover, given the expected unit costs or rents, their occupants will probably have average household incomes well above $100,000/year.

It is important to note that, as financially comfortable as the households in the 34th Street’s neighborhoods may be, their average household incomes are about 30% below those found in the zip codes in which the luxury retailing along Madison Avenue is embedded. The latter are also now more densely populated.

The 34th Street District’s close-in residential population of roughly 87,000 people is certainly an enviable and growing asset. However, that number is still dwarfed by the roughly 230,000 people who work within the 10-minute walksheds of district locations every weekday.

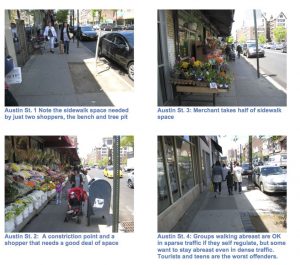

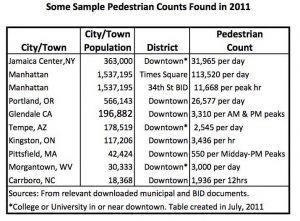

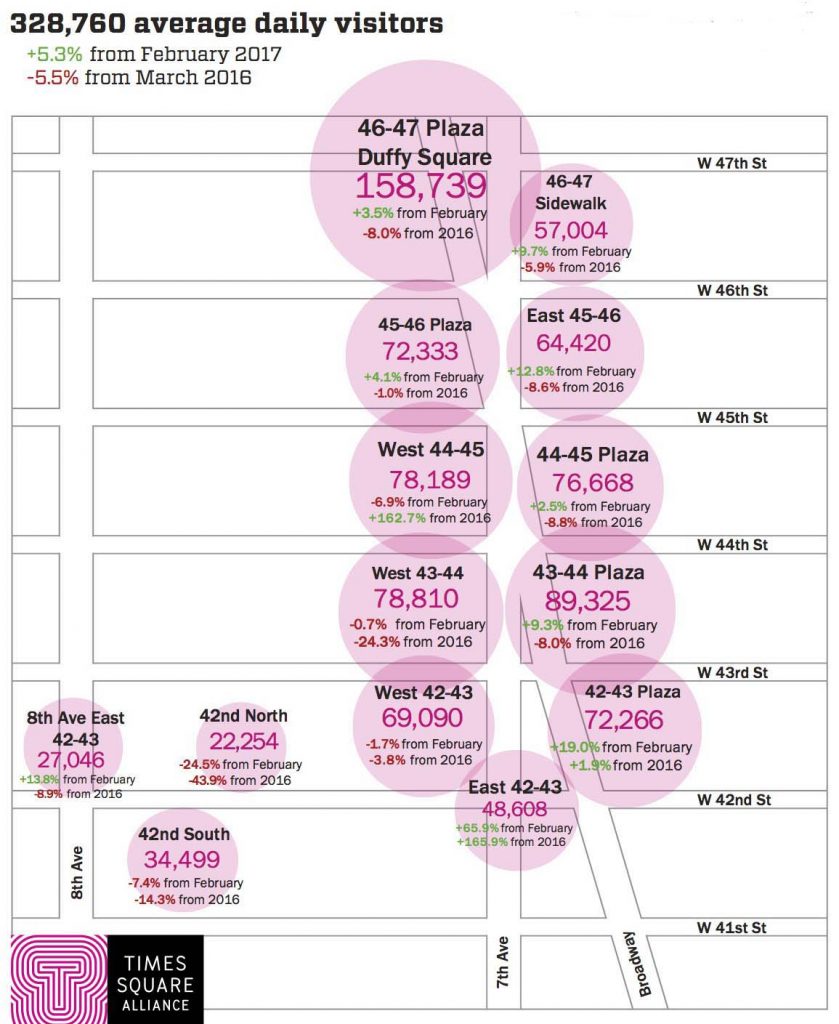

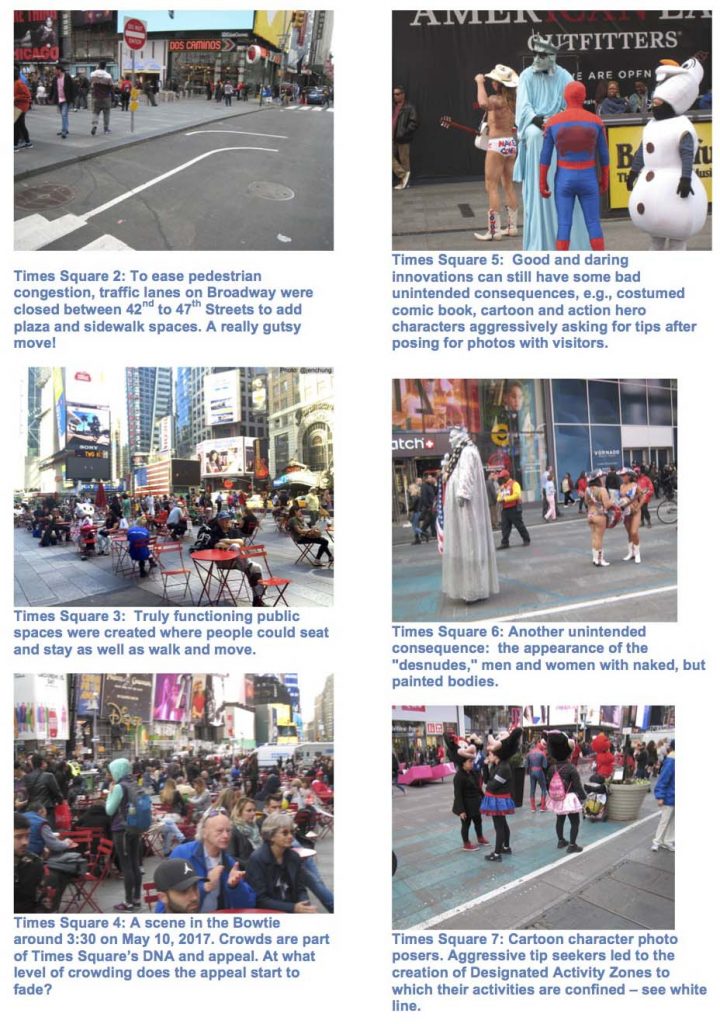

Pedestrian Traffic Levels. Given this density of major transit hubs, retailers, tourist attractions, employees, tourists and residents, one might expect high levels of pedestrian traffic. In this regard, the 34th Street District certainly does not disappoint!

The above table is taken from data published by NYCDOT for pedestrian counts it did in 2016 at 55 locations in NYC. The table shows the results for the 10 locations that had the highest counts. The top two – West 34th Street between Seventh Avenue and Broadway and Seventh Avenue between W32nd St and W33rd St – are in the 34th Street District. Given that, for some unknown reason, locations in the heart of the Times Square District that probably have extremely high pedestrian counts were not studied by NYCDOT, it is prudent to conclude that pedestrian traffic flows in the 34th Street District are among the very highest in Manhattan, NYC and the USA.

The 34th Street counts are by Macy’s and close to several subway stations and an entrance to Penn Station. To put the 4-7pm count of 33,102 in perspective, that is larger than the total populations of Westfield NJ, Monterey, CA, Gloucester, MA or Sandusky OH. My “guesstimate” is that for the 12 hour 7:00 am to 7:00 pm period, at least 75,000 pedestrians passed along this block on 34th Street.

The 31,856 count on Seventh Avenue is right by Penn Station and reflects a large number of commuters on their way home.

The 34 Street Partnership has long done its own pedestrian counts and at many more locations in the district than NYCDOT. Its data give a much clearer picture of where the pedestrian flows are strongest (see the table above).

How pedestrian counts impact retailer locational decisions is not easy to deduce from the situation in the 34th Street District. While I have been told by retail site selectors, commercial brokers and BID managers that pedestrian counts are now a critical factor, other considerations such as rents, the character of available spaces, lease timings and landlord behaviors can also strongly shape locational decisions. Here are some aspects of the current situation on the ground in the district that I believe are worthy of attention:

- The highest pedestrian counts, in the 10,000 to 12,000 per hour range, are for a north-south flow in front of a Citibank on the NW corner of 34th Street and Seventh Avenue. They are substantially higher than the counts for east –west flows in front of this bank. While the bank is directly across Seventh Avenue from an important entrance to Macy’s and across 34th Street from a busy entrance to Penn Station, until very recently this area has not been able to attract a lot of strong retailers. A Swarovski has replaced a Tourneau on the SW corner, an H&M has opened on the SE corner and a DSW opened a few stores west of the bank on 34th

- W34th Street between 5th Avenue and Broadway/6thAvenue has average pedestrian counts during the pm rush in the 4,000 to 5,000 range, but it has attracted a host of well-regarded retailers, many of which appear to be doing well under the new normal: e.g., Zara, Forever 21, Uniqlo, Superdry, Victoria’s Secret, Banana Republic, Gap and AEO. This cluster of strong national retailers suggests that this is the most desirable block for them in the district. The rents they pay suggest the same conclusion.

- W34th Street on the block between Broadway/6th Avenue and Seventh Avenue directly across from Macy’s has average pedestrian counts that are significantly higher, in the 6,000 to 8,000 per hour range, but the above chains did not locate there. However, this block recently has become extremely hot. It is where the new Target store will locate in a redevelopment that will also include Sephora, Footlocker and Swatch stores. H&M must really want to be in the district and on this block: it has opened two stores on its eastern and western ends. Long leases with relatively cheap rents apparently were, in the past, a barrier to recruiting stronger retail tenants to this block.

- Pedestrian counts along 34th Street west of Seventh Avenue seem to decline appreciably and in the past so has the quality of the retail. However, the properties across from Penn Station seem to be either getting better tenants or awaiting redevelopment. That will probably be impacted by Manhattan West and Hudson Yards.

- Major retailers seem to appreciate high pedestrian counts close to Macy’s and other major retailers more than high pedestrian counts close to Penn Station.

The Partnership’s pedestrian counts were also conducted in front of some newly vacated retail spaces. While the sample was admittedly small, comparing their counts with those in front of still active retailers showed no significant differences. Furthermore, when looking at the retailers who left, most were either in chains that were in retreat or that targeted market segments that have had a significantly weakened presence in the district in recent years. There were also some moves within the district, e.g., H&M and Modell’s, where the new locations had higher counts.

There is little doubt in my mind that strong pedestrian traffic is now, and will be in the future, an important factor in the retail recruitment process. However, the situation in the 34th Street District indicates to me that its impact is not solitary or simple or linear.

Retail Spaces: Sizes, Rents, Vacancies and Who to Attract. All too often on my consulting assignments I have found that a downtown’s revitalization was being impeded by a lack of appropriate office, entertainment or retail spaces. In the course of my research for this article, I was surprised when four observations provoked me to ask if the 34th Street District has the available store spaces needed to attract the retailers who today are thriving under the new normal and who would probably find locations in the district attractive:

- The Manhattan Mall reportedly has twice the sales PSF of the typical mall of its size. However, observers have argued that its large atrium design wastes a lot of potentially leasable retail space and that it cannot accommodate retail tenants with really large space requirements

- Is H&M at two locations on a block across from Macy’s on 34th Street because they thought that would enable them to capture more customers or because they could not find the much larger sized single space on that block that they really wanted?

- Observers have argued that from a real estate perspective, the Macy’s store could produce greater revenues if its retail space was reduced and other uses were brought to the property. It was also noted that customer traffic drops appreciably at each floor as you go up in the store.

- I recently saw that on Market Street in Center City Philadelphia the old Galleria Mall was being converted by PREIT and Macerich into the Fashion Outlets of Philadelphia. Sitting over a major SEPTA station in a downtown that attracts loads of tourists and has a very large number of office workers, the location reminded me of 34th While the full tenant list has not been released, the two I was able to identify, Ross for Less and Century 21, suggest the developers are going after the off-price brick and mortar retailers that have been doing very well under the new normal for retailing. Where, I wonder, could a similar project be developed in the 34th Street District? Or where, I wonder, could retailers such as Nordstrom Rack, Saks Off-Fifth, Century 21, TJ Maxx, Ross for Less, Ann Taylor Factory, and outlets stores of Polo Ralph Lauren, Armani, Lululemon, Orvis, Kate Spade, Coach, Columbia, Theory, etc. locate as a cluster in the district?

The off-price concept already has been introduced by Macy’s. It has created a new off-price chain, Backstage, that has both its own stores (e.g., on Fordham Road in the Bronx) and departments within existing Macy’s stores. Heavily discounted apparel merchandise was certainly evident at the mother store at Christmas time.

Today, the district’s most likely shoppers –the new workforce and residents in the walk sheds as well as its tourist visitors — are substantially more affluent than the shoppers drawn to the district over the prior three decades. As noted above, this affluence probably cannot support another luxury retail corridor like Madison Avenue – even with the addition of Hudson Yards and Manhattan West. However, developing an “upscale off-price” project or cluster would position the district to tap the new affluence in its neighborhoods – especially the surprisingly many deliberate consumers among them –as well the relatively high spending potential of its many tourists. Tourists love getting value bargains and visiting off-price, outlet and factory stores.

Another reason that off-price retailers may not have entered the district in greater numbers is the existence of agreements or behavioral patterns that keep them from being located too close to their existing stores — or Macy’s, JCPenney, Manhattan Mall, Herald Center, etc. If so, the future of the district’s retail may depend on the removal of such barriers to entry.

Also, a number of them – e.g., TJ Maxx and Burlington –already have locations along 6th Avenue about a mile south of the district.

Macy’s and JCPenney will probably struggle for some time to find a successful operational formula, as will the other traditional department store chains such as Nordstrom and Neiman Marcus. The Hudson’s Bay Company has reportedly been interested in acquiring both Macy’s and Neiman Marcus since both have become weakened and vulnerable to takeovers. Consequently, it seems very doubtful that other traditional department stores will be interested in locating in or near the 34th Street District anytime soon.

Ironically, the specialty retail chains may still be very good tenant prospects for the district:

- While the entire GAP chain has been searching for a new winning formula for many years now, the GAP store on 34th St is reportedly the highest grossing in the chain. In recent years, I also have heard reports that several other specialty retailers are doing very well in the district. It may be that the district’s locational assets are so strong that these retailers can thrive in the district, though they are struggling today in many other locations.

- Significantly, many of these chains are converting their existing stores into “outlet” or “factory” stores. Ann Taylor, Banana Republic, Gap, American Eagle and Nine West are among those that have followed this path.

The opening of an Amazon Bookstore on 34th Street suggests other e-retail companies that are opening brick and mortar stores also may find locations in the 34th Street District very attractive: e.g., Athleta (another Gap brand), Bonobos, Dyson, Duluth Trading Co., Shinola, Nasty Girl and Warby Parker. Soho has attracted many “one-off” versions of such stores that should be watched for growth and expansion.

Vacancies and Rents. A Marketbeat report for Manhattan for Q4 2016 by Cushman & Wakefield noted that:

“Rising annual availability rates in every major Manhattan retail submarket continues to generate uncertainty, as new stores come to market daily. Further compounding this trend is a slowdown in leasing, as tenants taper demand due to overall margins constricted by pressure from e-commerce retailers. Asking rents continue to decline, and it may take some time before activity increases and available retail space is leased faster than it comes to market.” (6)

The report found that the Herald Square West 34th Street submarket followed this pattern.

A vacancy survey of locations on 34th Street between Park and 10th Avenues done in late January 2017 by the 34th Street Partnership showed that of 122 storefronts there were 13 vacancies, 9.84% of the total. The highest vacancy rate was for the blocks between Park and Fifth Avenues, where 30.8% of the 13 stores were vacant. However, these two blocks have little of the GAFO type retailing that is so vulnerable to Internet sales losses. Only one of the four tenants that left was in this category. Also, the block face on the north side of 34th between Madison and Fifth has a large non-retail use that is a huge pedestrian discontinuity.

Surprisingly, the lowest vacancy rate was between 7th and 10th Avenues where just 2% of the 51 stores were vacant. Other stores in this area were vacant, but they reportedly were being held off the market for potential redevelopment reasons. In the core area between 5th and 7th Avenues, 13.8% of the stores were vacant. Of the six tenants that left from the block between 5th and 6th/Bway, four were GAFO stores and one of them, H&M, moved into a new location elsewhere in the district. Two of the other GAFO retailers were in chains that were generally in retreat. Again on this block, the influence of the Internet was confined to possibly affecting three of the six departing tenants. On the block between 6th Ave/Bway and 7th Avenue, only one of the two departing tenants may have done so because of e-commerce competition, and it was a relatively weak chain, to begin with.

While the Cushman & Wakefield report is probably right that vacancies in retail-prone spaces have risen in all of Manhattan’s major retail submarkets, they may have overstated the impact of the Internet in some of them where non-GAFO tenants were vacating many spaces. This seems to have been the case in the 34th Street District. In turn, if this is a trend in the district, and if its GAFO retailers are doing better than the district’s fast food and convenience operations and their GAFO peers elsewhere in Manhattan, that would be a very important finding. It would support the hypothesis that, even in the face of growing e-retail sales, the district’s exceptionally strong locational assets still make it a great place for GAFO retailers to do business.

According to the Cushman & Wakefield report, asking rents in the Herald Square 34th Street submarket averaged $783 PSF in Q4 of 2016 and had decreased by 4.3% since the prior year. Data published by REBNY showed that in 2016 dollars, back in the Fall of 2008, on West 34th Street from 5th to 7th Avenues, the average asking rent was $720 PSF and that during the Great Recession it fell to $472. By Fall 2016 it was $745, about 3% above pre-recession levels.

While the rents along 34th Street are certainly hefty, they are well behind other Manhattan submarkets along Fifth Avenue, in Times Square and along Madison Avenue. Also, within the district, there is considerable variation: asking rents east of 5th Avenue and west of 7th Avenue are about half of those from 5th to 7th. It will be interesting to see how the completions of Hudson Yards and Manhattan West influence both rent levels west of 7th Avenue and the redevelopment of more properties in that area.

Small retailers, even the really good ones, will likely find these rents unaffordable – even the lower ones in the “shoulder” areas. Within the district, they may find more affordable locations on the quieter side streets. As for the retail chains, unless they are opening “billboard” stores, their location in the district will have to bring in comparatively large sales to justify the costs of the space they are leasing. The district’s strong locational assets promise that such strong sales numbers can be achieved. However, they still have to be damned good merchants to realize their location’s sales potentials.

LOOKING TO THE FUTURE

I certainly do not know how retail will develop in the 34th Street District over the coming decade. However, I do feel certain that it will be very thought provoking and have important implications for retail development in downtowns elsewhere in the nation.

That said, I hope that in the above analysis I have developed some plausible hypotheses relevant to its future. Retail, nationally, has been hurt by two major factors: Internet commerce and deliberate consumers. It seems to me that my analysis supports the conjectures that:

- The 34th Street District’s strong locational assets might make it significantly less vulnerable to Internet sales, though some retail formats will continue to fail

- Its increasingly more affluent and large potential walk-in customer base makes it significantly less susceptible to deliberate consumer constraints, especially if the district can attract more upscale off-price/outlet retailers.

Other factors, notably the district’s central social district functions, will also probably have a strong influence on how many people it attracts and how “sticky” it will be keeping them there. I have not been able to properly research these functions, though my suspicion is that, in particular, how the district’s existing and new public spaces perform will have important impacts on nearby retail.

I certainly will continue to keep an eye on this fabled retail district to see how the next chapter in its story unfolds.

ACKNOWLEDGEMENT

Special thanks to Dan Pisark, Vice President, Retail Services at the 34th Street Partnership for providing some very essential data.

ENDNOTES

1-Richard Florida and Charlotta Mellander. “Rise of the Startup City: The Changing Geography of the Venture Capital Financed Innovation.” California Management Review. January 27, 2017. http://journals.sagepub.com/doi/abs/10.1177/0008125616683952?journalCode=cmra

2-Lois Weiss, “Massive Target Store Coming to Midtown,” New York Post, March 19, 2017.

3-Arianne Cohen. “A Department store: Macy’s Herald Square. New York Magazine. June 3, 2007. http://nymag.com/news/features/2007/profit/32899/

4-Anne D’innocenzio. “Lower Spending From International Tourists Hurts Macy’s 1Q Sales And Profit.” US News. May 13, 2015. https://www.usnews.com/news/business/articles/2015/05/13/macys-misses-street-1q-forecasts

5-Mitchell L. Moss and Carson Qing. “The Dynamic Population of Manhattan.” Rudin Center for Transportation Policy and Management . New York University. March, 2012

6-Cushman & Wakefield. Marketbeat Manhattan: Retail Q4 2016. http://www.cushmanwakefield.com/en/research-and-insight/unitedstates/manhattan-retail-snapshot/